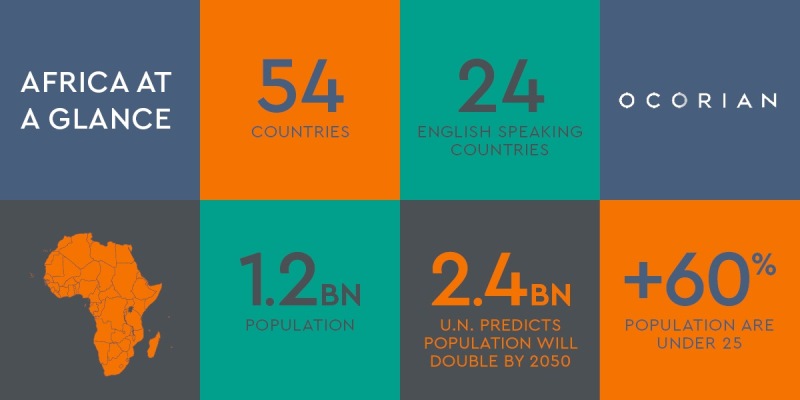

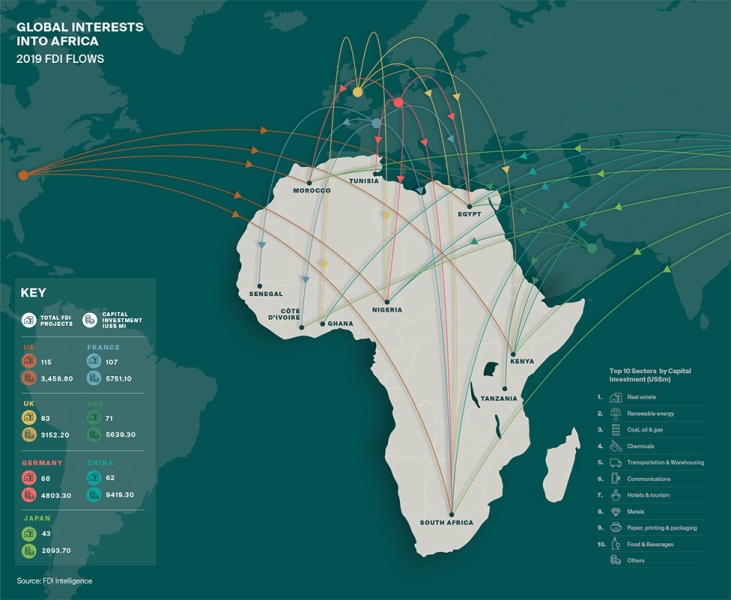

With a population of more than 1.2 billion and an economy that is currently experiencing rapid growth, Africa is a continent that is on the rise. This means investing in Africa is an excellent idea for the future. And these investment opportunities cut across various sectors, ranging from agriculture and energy to technology and infrastructure, even through its difficulties.

However, some risks must be carefully managed. The opportunities and risks of investing in Africa will be discussed in this article. We’ll also mention tips on taking advantage of the continent’s slew of potentials while avoiding pitfalls.

Whether you’re a seasoned investor or are just getting started, you won’t want to miss this guide.

Opportunities for Investing in Africa

Interestingly, Africa has vast potential for growth and development. This means many investors are willing to hop on these opportunities. As you should, too.

But where should you put your resources? Here are some of the best places to channel your money and time for the next decade:

Agriculture

Many African economies are built on agriculture, which contributes significantly to the continent’s GDP and employment. Large tracts of arable land in Africa make it a prime location for investing in agribusiness.

This means investors have many opportunities in Africa’s agricultural sector, from large-scale farming to value-added processing and logistics. For those seeking long-term gains, investing in African agriculture makes sense. This is especially critical given the growing global demand for food and the rising cost of commodities.

Energy

Oil, gas, and renewable energy sources are among the numerous natural resources in Africa. Many African countries are sitting on a pot of “new gold,” as Daniel Yergin once put it. And quite frankly, Africa is becoming more appealing to energy investors as the world moves towards renewable energy.

In Africa, where many regions are blessed with sunshine and powerful winds, renewable energy sources like solar and wind power have a lot of potential. As the continent’s energy needs increase, investing in the sector can yield long-term returns.

There has also been a demonstrated political will on the part of African countries. For example,

Ghana intends to increase the proportion of renewable energy in its national energy generation mix from 42.5MW to 1,363MW by 2030.

In addition, Angola plans to reach 70% renewable capacity by 2025. Lastly, Senegal aims to reach 30% renewable energy in its national energy mix by 2030.

These goals demonstrate the political will and opportunities available in African markets.

The demand for electricity in Africa also makes it an attractive prospect for investing in the continent. For instance, more than 500 million people have no access to electricity in Africa. That’s almost half of the entire population.

Technology

Africa’s technology industry is expanding quickly, and the number of tech startups on the continent is rising.

Thanks to mobile and internet connectivity expansion, Africa is now a desirable location for tech investors. This has opened up new opportunities for innovation and entrepreneurship.

The fact that so many African tech startups are devoted to addressing regional problems like financial inclusion and healthcare gives investors the chance to have a significant social impact while also making money.

Infrastructure

Although the lack of infrastructure in Africa is a severe issue, it also offers investors a chance. There is an urgent need for infrastructure investment because there are significant gaps in transportation, energy, water, and sanitation.

Infrastructure investments can offer stable, long-term returns while also advancing the continent’s development.

Put Your Tech Company on the Map!

Get featured on Nicholas Idoko’s Blog for just $50. Showcase your business, boost credibility, and reach a growing audience eager for tech solutions.

Publish NowFor example, improved transport access can improve education and provide more markets for farmers’ outputs. It will cut costs, facilitate more private investment, and improve jobs, income levels, and cost of living for many.

Mining

Beyond oil and gas, minerals and natural resources, such as gold, diamonds, and copper, are abundant in Africa.

Many African economies depend heavily on the mining sector, which also contributes significantly to exports and tax revenue.

Investing in mining projects in Africa can offer investors long-term returns, particularly in areas with sizable untapped mineral reserves.

Real Estate

Urbanization, population growth, and rising income levels have contributed to the rapid growth of the African real estate market in recent years. In cities with a dearth of affordable housing, the demand for residential and commercial real estate is rising across the continent.

Investing in real estate in Africa can offer investors steady, long-term returns, especially in the residential and commercial property markets.

However, the dynamics of the local market, legal requirements, and risk management techniques must all be carefully considered when investing in real estate in Africa.

This also applies to every other form of investment. In the following paragraphs, we’ll discuss the risks you might encounter while investing in Africa and ways to navigate them.

Read: How to Invest in Real Estate without Buying Property

Risks in Investing in Africa

You might remember the saying, “Every rose has its thorn.” This means that while there are many opportunities for investment in Africa, there are also several risks that should be carefully considered.

But every investor worth their salt would tell you there is no investment without risks. You need proper risk management. Here are the potential bottlenecks to expect when investing in Africa:

Political and Regulatory Problems

Political unpredictability and regulatory difficulties stand as significant problems for African investors. The political and regulatory environment on the continent is notoriously complicated. And this can lead to uncertainty and deter investment.

Governmental changes, bribery and corruption, and substandard institutions can produce an unstable investment environment. This can hinder investors’ ability to protect their capital and earn returns.

Economic Risks Stand in the Way of Investing in Africa

Investors in Africa should also be concerned about economic risks like currency fluctuations, inflation, and high debt levels. Since the economies of many African nations are unstable, prospective investors must consider this before making any investments on the continent.

They must also implement effective risk management strategies to reduce these potential pitfalls because economic instability significantly negatively impacts investment returns.

Security Risks

Put Your Tech Company on the Map!

Get featured on Nicholas Idoko’s Blog for just $50. Showcase your business, boost credibility, and reach a growing audience eager for tech solutions.

Publish NowOther significant obstacles for investors in Africa include security risks such as terrorism, crime, and civil unrest. It is no news that the history of violence and conflict in many African nations can make the investment climate unstable.

When investing in Africa, investors must carefully weigh the security risks and create plans to reduce these risks. This could be achieved through comprehensive insurance and focusing on more secure metropolitan areas.

Operational Risks

Investment returns in Africa can also be impacted by operational risks like corruption, insufficient infrastructure, and a skilled labor shortage.

Hence, investors, especially those in industries like transportation and energy, face a significant challenge due to the continent’s infrastructure deficit.

As a closing note, value for money is the only risk reduction strategy after dealing with the other fear factors. And this is where insurance comes in.

It is essential that every investor, in one way or another, considers insurance when investing. You must also ensure that all contracts are legally documented. This information is useful for both individual and corporate investors.

Mitigating Risks in Investing in Africa

Let’s look at some more practical tips on how to lower the risks associated with investing in Africa.

Do Your Own Research (DYOR)

Before investing in any African project or business, due diligence must be done thoroughly. In this process, you must investigate the business or project, its financial performance is evaluated, and the risks are assessed.

Additionally, the political and regulatory climate in the nation or region where investors intend to invest must also be considered. A thorough due diligence procedure helps investors make wise investment choices and prevents costly errors.

Partner with Local Experts

Another effective approach for reducing risks when investing in Africa is by partnering with local authorities.

Regardless of how experienced you already are in the industry you intend to invest in, you must make grassroots networks from day one.

Local partners can offer insightful information about the local market, assistance navigating legal and regulatory issues, and access local networks.

Additionally, partnering with local experts can lower investment risks by assisting investors in understanding the specific difficulties and opportunities in the African market.

Diversify Your Portfolio

The age-old advice applies here; do not put all your eggs in one basket.

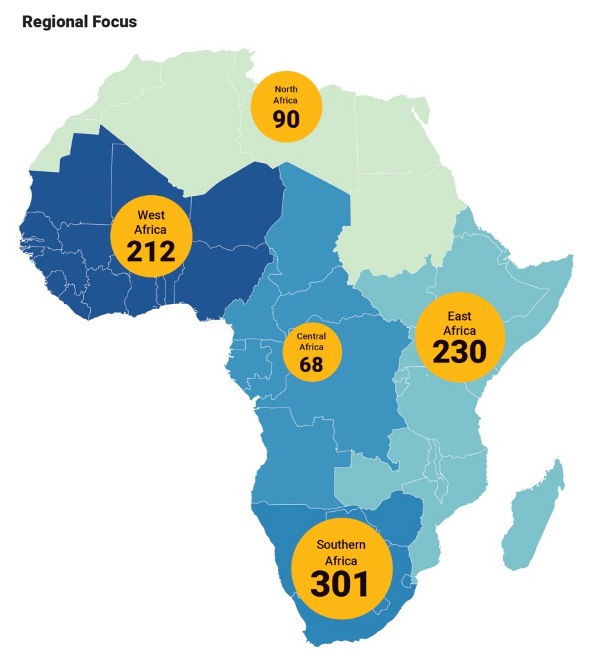

When investing in Africa, you can reduce exposure to market volatility and other risks by diversifying your portfolio across various industries and geographical regions.

Diversification can also help take advantage of the opportunities presented by various African markets.

Implement Robust Risk Management Strategies

When investing in Africa, it is necessary to put effective risk management strategies into place. Identify potential risks, assess their effects, and plan mitigation strategies.

Put Your Tech Company on the Map!

Get featured on Nicholas Idoko’s Blog for just $50. Showcase your business, boost credibility, and reach a growing audience eager for tech solutions.

Publish NowInsurance coverage, currency hedging, and comprehensive internal controls to avoid fraud and corruption are some examples of risk management techniques.

Having put any or all of these in place, do not forget to monitor regularly. This will allow you an update on whatever is going on with your investment(s) and alert you when immediate steps are needed.

Case Studies of Successful Investments in Africa

Despite the risks associated with investing in Africa, there are significant and successful investors on the continent, some of whom have been around for quite some time (several years). Check some of such investments out below:

Coca-Cola in Africa

Since it began doing business in Africa more than 90 years ago, Coca-Cola has developed into one of the most prosperous corporations on the continent.

The business has made significant investments in expanding its distribution network, giving it access to even inaccessible places.

To support job creation and economic growth in the areas where it operates, Coca-Cola has also partnered with regional farmers and suppliers. And as a result of this, the company is now well-known throughout Africa and is actively expanding there.

KCB Group in Kenya

Kenya Commercial Bank is one of the biggest banks in East Africa and a key player in the region’s banking industry.

KCB has made investments to develop a substantial and diversified portfolio, putting particular emphasis on SME financing, mobile banking, and retail banking.

Tanzania, Uganda, Rwanda, and South Sudan are just a few of the additional African nations where the bank now conducts business.

Kibo Energy in Tanzania

A UK-based energy company called Kibo Energy has made investments in Tanzanian power project development.

The Mbeya Coal to Power Project, the company’s flagship endeavor, aims to develop a 300MW coal-fired power plant in southern Tanzania. And to complete the project, Kibo Energy has partnered with regional businesses and successfully secured funding for it.

Before you go…

Hey, thank you for reading this blog to the end. I hope it was helpful. Let me tell you a little bit about Nicholas Idoko Technologies. We help businesses and companies build an online presence by developing web, mobile, desktop, and blockchain applications.

We also help aspiring software developers and programmers learn the skills they need to have a successful career. Take your first step to become a programming boss by joining our Learn To Code academy today!

[E-Books for Sale]

1,500 AI Applications for Next-Level Growth: Unleash the Potential for Wealth and Innovation

$5.38 • 1,500 AI Applications • 228 pages

Are you ready to tap into the power of Artificial Intelligence without the tech jargon and endless guesswork? This definitive e-book unlocks 1,500 real-world AI strategies that can help you.

See All 1,500 AI Applications of this E-Book

750 Lucrative Business Ideas: Your Ultimate Guide to Thriving in the U.S. Market

$49 • 750 Business Ideas • 109 pages

Unlock 750 profitable business ideas to transform your future. Discover the ultimate guide for aspiring entrepreneurs today!

Put Your Tech Company on the Map!

Get featured on Nicholas Idoko’s Blog for just $50. Showcase your business, boost credibility, and reach a growing audience eager for tech solutions.

Publish NowSee All 750 Business Ideas of this E-Book

500 Cutting-Edge Tech Startup Ideas for 2024 & 2025: Innovate, Create, Dominate

$19.99 • 500 Tech Startup Ideas • 62 pages

You will get inspired with 500 innovative tech startup ideas for 2024 and 2025, complete with concise descriptions to help you kickstart your entrepreneurial journey in AI, Blockchain, IoT, Fintech, and AR/VR.

We Design & Develop Websites, Android & iOS Apps

Looking to transform your digital presence? We specialize in creating stunning websites and powerful mobile apps for Android and iOS. Let us bring your vision to life with innovative, tailored solutions!

Get Started Today