Financial stability is highly regarded as a cornerstone of successful relationships. This is especially true in African communities where financial security is highly valued and sought after.

Being financially stable is regarded as a personal accomplishment in many African cultures. It also reflects one’s responsibility and maturity level in a relationship.

The ability to provide for oneself and one’s family is viewed as a measure of success. And it frequently plays a significant role in the decision to pursue a long-term commitment, such as marriage.

In today’s fast-paced and ever-changing world, the need for financial stability has become even more pressing. It has made it a significant factor in establishing and maintaining healthy relationships.

With the challenges of economic uncertainty and financial insecurity, partners must work toward financial stability. Not just for themselves, but also for the future of their relationship and family.

So, let us explore the importance of financial stability in African relationships. And how it can shape our relationships’ future and the security of our families.

What Does Being Financially Stable Mean?

Financial stability is the ability to manage one’s finances in a manner that allows for long-term financial security and independence. It encompasses a range of factors such as having a stable income, managing debt effectively, having adequate savings, and planning for the future.

Being financially stable is an important part of personal well-being. It allows individuals to meet their financial needs, achieve their financial goals, and secure their financial future.

Having financial stability involves managing money responsibly and sustainably. To be financially stable, you’ll need to avoid excessive debt and spending. It’s also necessary to plan for unexpected events such as job loss, medical expenses, or other emergencies.

In addition, financial stability requires an understanding of one’s personal finances. This includes income, expenses, and the ability to create and stick to a budget.

Financial stability is a key component of overall financial health. It allows individuals to build wealth, secure their financial future, and provide for themselves and their families.

Innovative Tech Solutions, Tailored for You

Our leading tech firm crafts custom software, web & mobile apps, designed with your unique needs in mind. Elevate your business with cutting-edge solutions no one else can offer.

Start NowWithout financial stability, it becomes difficult to achieve financial goals, meet financial needs, and secure financial independence, leading to stress and uncertainty.

Read: 5 Misleading Tips On Personal Finance

The Importance of Financial Stability in African Relationships

The cultural significance of financial stability in African relationships can be seen in the expectation that partners will provide for themselves and their families. This expectation is rooted in traditional African values that place a strong emphasis on financial security and independence.

A partner’s ability to provide for themselves and their family is seen as a reflection of their success, maturity, and responsibility. As a result, financial stability is a key factor in the decision to pursue a long-term commitment such as marriage.

Financial stability is important in the growth of relationships. It lays the foundation for couples to plan for their future and achieve their financial objectives. It also helps reduce financial stress and uncertainty, allowing people to concentrate on the emotional and psychological aspects of their relationships.

However, achieving financial stability in today’s fast-paced and ever-changing world can be difficult. This is especially true considering the economic uncertainty and financial insecurity playing a significant role.

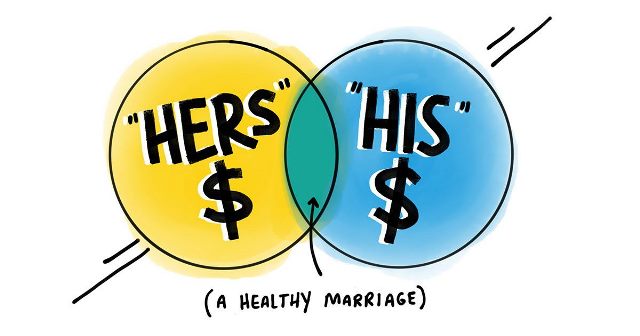

As such, couples must work together to become economically stronger. This can include developing a budget, managing debt, saving for the future, and investing in their financial well-being.

The Cultural Significance of Financial Stability in African Relationships

The cultural significance of financial stability in African relationships is rooted in traditional African values that place a high value on financial independence and security.

In African communities, having a stable income, managing debt effectively, and having adequate savings are seen as hallmarks of success and responsibility.

It is expected that a man must provide for himself and his family. The ability to do so is seen as a reflection of their success and maturity.

A partner, especially the man, is expected to have his finances in order and to have a clear plan for his financial future.

In African relationships, cultural expectations for financial stability extend to other aspects of life, such as education and career. Education and career success are highly valued in many African communities, and the ability to provide for oneself and one’s family is seen as a reflection of these values.

Because of the cultural emphasis on financial stability and independence, it is an important component of relationships in African communities.

Read: How To Build Trust In a Relationship

Seamless API Connectivity for Next-Level Integration

Unlock limitless possibilities by connecting your systems with a custom API built to perform flawlessly. Stand apart with our solutions that others simply can’t offer.

Get StartedThe Practical Implications of Financial Stability in African Relationships

One of the most significant practical implications of financial stability in African relationships is its impact on the ability to plan for the future.

Financial stability provides individuals and couples with the foundation for building a secure future together. It also allows them to plan for their financial goals, such as buying a home, starting a family, or saving for retirement.

Without financial stability, it becomes difficult to achieve these financial goals. And this can lead to stress, uncertainty, and a lack of confidence in the future.

Another practical implication of financial stability in African relationships is its impact on reducing financial stress. Financial insecurity can be a source of stress in relationships. This happens when partners can’t meet their financial needs or are constantly struggling with debt.

Being financially stable allows individuals and couples to reduce this stress because they will have a sense of security and independence. As a result, they’re able to prioritize the emotional and psychological aspects of their relationships.

Financial stability also plays a crucial role in reducing financial uncertainty and insecurity. In today’s world, economic uncertainty is a major concern, and financial insecurity can be a significant source of stress and anxiety.

However, financial stability provides individuals and couples with a sense of security and confidence in their finances. This allows them to better manage their finances, invest, and prepare for unexpected events such as job loss or medical expenses.

The Challenges of Achieving Financial Stability in African Relationships

One of the biggest challenges of achieving financial stability in African relationships is balancing conflicting financial priorities. Partners may have different financial goals, such as saving for a down payment on a home, starting a business, or paying off debt.

Unfortunately, these priorities may conflict with one another. This can lead to disagreements and misunderstandings, making it difficult for partners to work together toward financial stability.

Another challenge in achieving financial stability in African relationships is managing debt. High levels of debt, such as credit card debt, student loans, and medical bills, can be a significant obstacle to financial stability.

In some cases, the burden of debt can be so significant that it becomes difficult to save, invest, or make progress toward financial goals.

Another barrier to financial stability in African relationships is a lack of financial literacy and education. Financial literacy is the ability to understand and apply financial information to make sound decisions.

This category of literacy and its effective application of it is no doubt tantamount to achieving financial stability. Hence, individuals and couples who lack financial literacy may struggle to understand how to manage their finances, reduce debt, or save and invest.

Finally, external factors such as job loss, economic uncertainty, or unexpected expenses can also pose significant challenges to achieving financial stability in African relationships.

Transform Business with Custom CRM & ERP Solutions

Elevate your operations with a CRM or ERP tailored for you. Let’s build the perfect solution that others can't replicate—crafted to match your business's needs like no other.

Get StartedManaging Financial Challenges in African Relationships

Financial challenges can be particularly difficult to manage because they are often beyond the control of individuals and couples. And they can impact their financial stability even if they have been working hard to achieve it.

Ultimately, financial stability plays a crucial role in the success and longevity of relationships. It is particularly critical in African communities where cultural values place a strong emphasis on financial security and independence.

Financial stability provides not only couples but also individuals with the foundation for building a secure future. Thereby, helping them in reducing financial stress, and reduce financial uncertainty and insecurity.

While achieving financial stability can be a challenge, couples have a better chance when they work together. They must set realistic financial goals and seek professional financial advice.

By prioritizing financial stability, individuals and couples in African communities can build stronger, more secure relationships that stand the test of time.

Future Implications for not Building Financial Stability in An African Relationship

Not building financial stability in an African relationship can have serious implications for the future of the relationship.

Here are some of the ways in which a lack of financial stability can impact an African relationship in the long term:

Financial Stress and Conflict

Without financial stability, couples in African relationships may experience constant financial stress and conflict, which can put a strain on the relationship.

Financial stress can lead to arguments and disagreements, causing tension and eroding the trust between partners.

Reduced Standard of Living

A lack of financial stability can also reduce the standard of living for both partners. This makes it difficult to meet basic needs, leading to dissatisfaction and unhappiness. Unfortunately, it can result in a decline in quality of life and reduced financial security.

Tailored Tech Solutions to Drive Your Business Forward

Maximize your business potential with custom tech strategies. We deliver bespoke solutions that others can’t match, designed to solve your specific challenges with precision and impact.

Contact UsDifficulty in Planning for the Future

A lack of financial stability can also make it difficult for couples to plan for the future, such as saving for retirement, paying for their children’s education, or buying a home. This can make it challenging for partners to achieve their long-term financial goals and can lead to feelings of uncertainty and insecurity.

Before you go…

Hey, thank you for reading this blog to the end. I hope it was helpful. Let me tell you a little bit about Nicholas Idoko Technologies. We help businesses and companies build an online presence by developing web, mobile, desktop, and blockchain applications.

We also help aspiring software developers and programmers learn the skills they need to have a successful career. Take your first step to becoming a programming boss by joining our Learn To Code academy today!