You’ve definitely heard of an invoice, a bill, and a receipt, but you might not be aware of the minute distinctions that define each document for what it is. So let’s examine each one in turn so you can understand the distinctions between an invoice, a bill, and a receipt and know which documents to refer to when necessary.

Definitions

What is an Invoice?

An invoice is, to put it simply, a document that a business issues to a customer. It lists the goods or services that were sold, together with the price that must be paid. Before a customer makes a payment, invoices are sent out as a request for payment. They are employed to efficiently maintain a record of the sold goods, their costs, taxes, and other transactional data. Invoices are typically generated after the service or product has been delivered but before the money has been received.

In the past, invoices were frequently printed and distributed by mail or fax. Online invoices provided as PDFs via email are a more economical, practical, and environmentally friendly alternative now. Using a single, integrated invoicing system to keep track of invoices can assist streamline accounting and reporting.

What is included in an invoice document?

- Include the seller’s name, address, company registration number, and contact details.

- Add the buyer’s name and address to it.

- Mention the date of invoice issued, payment due date, and delivery date.

- Your unique identification invoice number.

- A line-by-line offered product or service including the quantity, cost per product or service, and the total cost.

- Add the charged total amount by including the tax information.

- Provide your bank account details, and don’t fail to add the payment methods.

- Adding the identification reference code for the customer will help you more and will make the invoice unique from another invoice.

You can use invoice software if you find that the process of issuing the invoice is too tedious and complicated.

What is a Bill?

You have to pay a bill if you’re a customer. A bill is similar to an invoice in that it includes an itemized list of the goods or services that were sold, the price that is due for each item, and the total amount due. On the other hand, you would record an invoice as a bill you owe when you receive one. In other words, a bill is received after an invoice is sent.

What is included in a bill?

- Date of Purchase: A bill should clearly mention the date of purchase, it helps in bookkeeping records.

- List of Items: The received bill must contain a list of line items purchased, with cost per unit, and the quantity.

- Price: Against every line item, the related price should be mentioned.

- Buyer’s Information: This must include the buyer’s name, billing address, email address, and contact number.

- Seller’s Information: A received bill should also include the name, address, and contact information of the seller or the service provider.

- Payment Methods: A bill should contain mentions of different payment methods in which transactions can be processed.

- Warranty/ Guarantee Policies: If your products claim to provide any warranty or guarantee, those should be added to the bill.

- Amount to be Paid: The bill should contain separate amounts for specific line items, and the total amount to be paid after all the calculations.

- Taxes: A bill should include a specific mention of taxes with the percentage charged.

- Signatures: The bill should have the signature of all the parties involved including the buyer, seller, and the notary public if required.

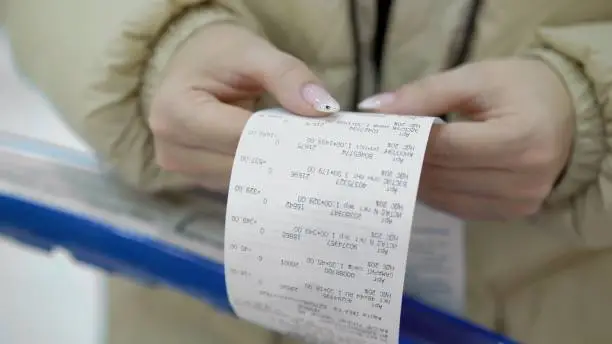

What is a Receipt?

A receipt serves as proof of a transaction. This document attests to the client’s receipt of the products or services. A receipt is an evidence that a purchase of goods or services has been made and paid for by the consumer. After the payment has been made, clients are provided receipts in either a digital or print format. This document is typical for both conventional and online firms and serves as crucial proof in the event that there are any problems with the goods. A receipt is used by a vendor to confirm the validity of any claims for exchanges or returns.

What is included in a receipt?

- Date of Purchase: The receipt must include the date and time when the purchase was made.

- Receipt Number: Every generated receipt should have a unique identification number that must be added to the financial books.

- Additional Charges: Any additional charges like tax, installation, or freight should be mentioned separately while issuing a receipt.

- Amount Paid: Along with separate line items, the total or partial amount that has been paid should be mentioned in the receipt.

- Seller’s Information: The receipt must contain the seller’s contact information like name, address, email, and phone number.

- Payment Method: The preferred payment method/s like cash, UPI, or debit card should be mentioned in the receipt.

- Return or Exchange Policy: Terms and conditions for returns and exchange of the product should be mentioned clearly in the receipt. This helps the clients get additional services when required.

Also read: 8 Strategies To Grow Your Business

Differences

Invoice vs Bill

Both an invoice and a bill attempt to convey the same information regarding the goods or services the seller provides as part of a business transaction; however, an invoice is produced by the seller who provides the goods or services, whereas the client receives an invoice in the form of a bill that must be paid.

Invoice vs Receipt

Receipts and invoices both serve as records of sales and generally contain the same data. When they are granted and how they are used for accounting purposes makes a difference. A receipt is sent after receiving payment from the customer, not before raising an invoice to request payment from the client.

A receipt is typically only given to customers who have made complete payments. The sale is regarded as closed after fulfilling any refund or replacement requests. A receipt serves as proof of a successful sale, which is recorded in the books as revenue.

However, sellers can send invoices to their clients who have credit accounts, allowing them to purchase the goods or services upfront and make payments later. Even better, sellers can divide the sum into multiple invoices and get payment in instalments.

In the accounting system, invoices are accounted for differently. The invoices are flagged for additional processing and are classified as accounts receivable rather than recording the sale as income. The sale won’t be deemed finished and recorded as income in the books until the entire amount owed for the delivered goods or services has been received.

Bill vs Receipt

The purpose and the moment when it is provided are the two main distinctions between a receipt and a bill. When a payment is due, a bill is received, whereas a receipt is obtained after the payment has been made.

A bill is a thorough document that contains a list of every line item purchased. However, the receipt only lists the total amount that has been paid in full or in part.

Also read: Differences Between B2B and B2C Businesses

Conclusion

In summary, if you are a vendor, you would issue an invoice once the goods are delivered to your client in order to collect the money owed. Create a receipt recognizing the payment once the consumer has paid you. If you are a customer, on the other hand, the invoice you receive from the supplier serves as your bill, and once you make payment, you will obtain a receipt.

Invoice is sent → Customer receives it as a bill → Payment is made → Receipt

Before you go…

Hey, thank you for reading this blog to the end. I hope it was helpful. Let me tell you a little bit about Nicholas Idoko Technologies. We help businesses and companies build an online presence by developing web, mobile, desktop, and blockchain applications.

We also help aspiring software developers and programmers learn the skills they need to have a successful career. Take your first step to becoming a programming boss by joining our Learn To Code academy today!

Be sure to contact us if you need more information or have any questions! We are readily available.

Put Your Tech Company on the Map!

Get featured on Nicholas Idoko’s Blog for just $200. Showcase your business, boost credibility, and reach a growing audience eager for tech solutions.

Publish Now